If you run a cannabis company, you’ve probably muttered “two-eight-zero-E” under your breath more times than you care to admit. The rule is simple, but brutal: the IRS forbids you from deducting ordinary business expenses. Rent, payroll, marketing, security—poof. The lone safe harbor is Cost of Goods Sold (COGS), calculated under the inventory rules of §471. Get that allocation wrong and you don’t just over-pay, you wave a red flag that can pull an IRS auditor out of the starting gate faster than Secretariat.

Why “Good-Enough” Books Are Nowhere Near Good Enough

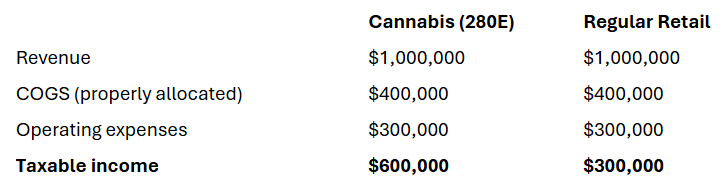

Imagine two retailers with identical top lines:

Slap on a 25% federal rate (your end-rate may vary) and the cannabis shop hands the IRS an extra $75,000. Miss a few COGS items because your books aren’t dialed in, and that gap widens faster than a photo-finish replay.

The 2025 Landscape: Rescheduling Rumors vs. Reality

Yes, the DEA was flirting with rescheduling, and Capitol Hill keeps floating “SAFE-this” and “MORE-that.” But until cannabis is fully de-scheduled or legalized, 280E remains the law of the land. Betting your tax strategy on political headlines is like handicapping a race based on the jockey’s Instagram feed -- fun dinner-table talk, terrible risk management.

Where Sophisticated Accounting Changes the Odds

Proper cannabis accounting is equal parts regulatory chess and forensic storytelling:

- Segment activities inside one entity: use rigorous class, location, and departmental tracking so revenue and costs for cultivation, manufacturing, and retail stand on their own. We reserve separate-entity structures for genuinely distinct businesses with their own profit motive, not as a back-door 280E workaround.

- Systematize COGS capture: from procurement through point-of-sale, so every allocable penny lands above the line.

- Document relentlessly with audit-trail clarity: invoices, time-tracking, and inventory roll-forwards that tie out down to the gram.

- Model tax scenarios quarterly, not once a year, so you can adjust inventory turns, pricing, or capital spending before it’s too late.

Done right, this approach doesn’t “beat” 280E... it uses the statute’s own language to minimize its bite while keeping you squeaky-clean with regulators.

How Dark Horse Cannabis CPAs Keeps You in the Winner’s Circle

At Dark Horse, we live and breathe cannabis ledgers. Our team:

- Builds bulletproof books that stand up to IRS scrutiny.

- Optimizes COGS under §471

- Designs fractional CFO dashboards so you see in real time where cash is leaking—and how to rein it back in.

- Guides long-range strategy so today’s tax savings compound into tomorrow’s profitability.

The Takeaway

Section 280E may feel like racing with a 50-pound saddle, but you’re not relegated to the back of the pack. With disciplined accounting, proactive tax planning, and a partner who knows the track, you can keep more of every dollar you earn, all while sleeping at night when the IRS gate clangs open.

Ready to run a tighter race? Let’s talk about turning 280E from a four-letter word into a manageable line item. Dark Horse Cannabis CPAs: where compliant books meet competitive advantage.

About Dark Horse CPAs

Dark Horse CPAs provides an integrated suite of services including tax, accounting, fractional CFO, and wealth management to small businesses and individuals across the U.S. The firm was established to transform the client experience by offering personalized, high-quality services that small businesses and individuals deserve. As Dark Horses in their industries, these businesses benefit from advanced tax strategies and accounting insights typically reserved for larger companies. With a nationwide presence and a team of dedicated professionals, Dark Horse CPAs is committed to your success. Get a quote today.

share

Get an expert Tax & Accounting CPA who will partner with you to achieve unparalleled results.